vermont department of taxes homestead declaration

A 1800 square foot home with 635 square feet used as a home office and inventory storage. Homestead Declarations must be filed annually.

Understanding Your Property Tax Bill Department Of Taxes

Handy tips for filling out Vermont homestead declaration online.

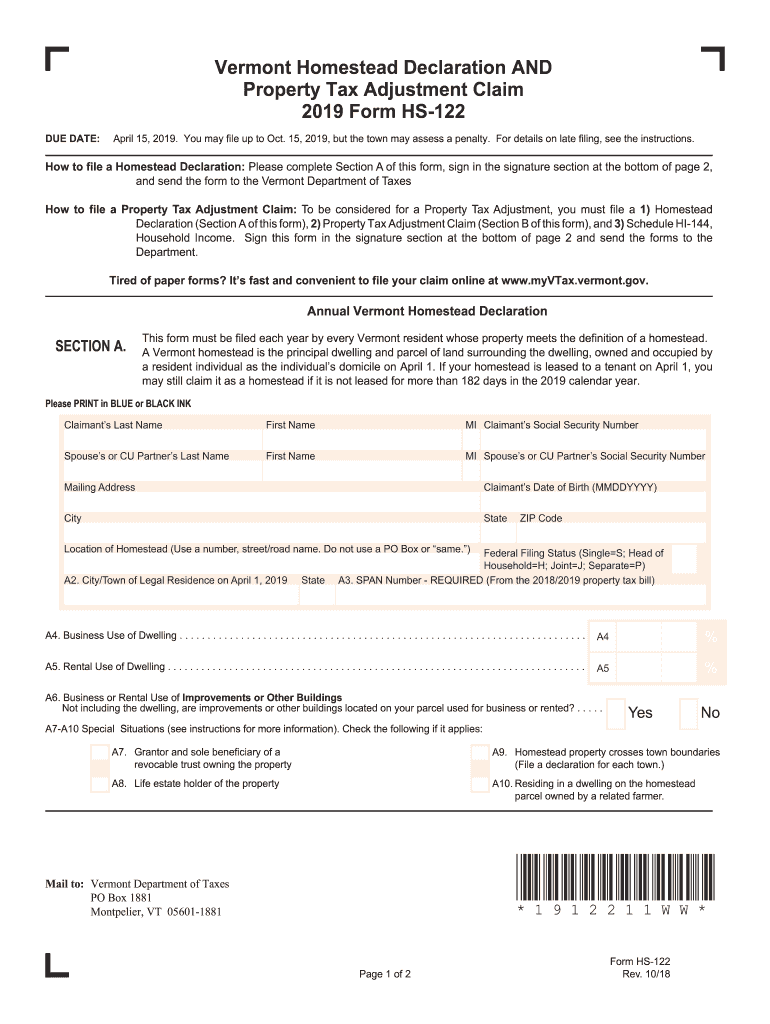

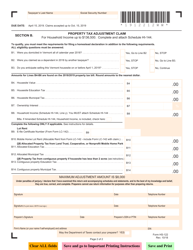

. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department. The Homestead Declaration is filed using Form HS-122 the Homestead Declaration and Property Tax Credit Claim or save time by filing your Homestead Declaration online. Those who are unable to meet the May 17 personal income tax filing deadline may file an application to extend to October 15 but taxpayers must still pay any tax owed by May.

Generally the business use percentage is the same as reported on your Federal income tax return. Vermont Income Tax Return. Local - Financing and Home Repairs.

2 were Vermont residents all of calendar year 2021. Mon 01242022 - 1200. Vermont Property Tax Homestead Declaration.

VT Department of Taxes is recommending taxpayers to file their HS-122 and HI-44 soon and not delay so tax bills and potential state. Property owners whose dwellings meet the definition of a Vermont homestead must. Once you have fulfilled the criteria you can apply for the exemption which will ensure that your state education tax rate is classified correctly.

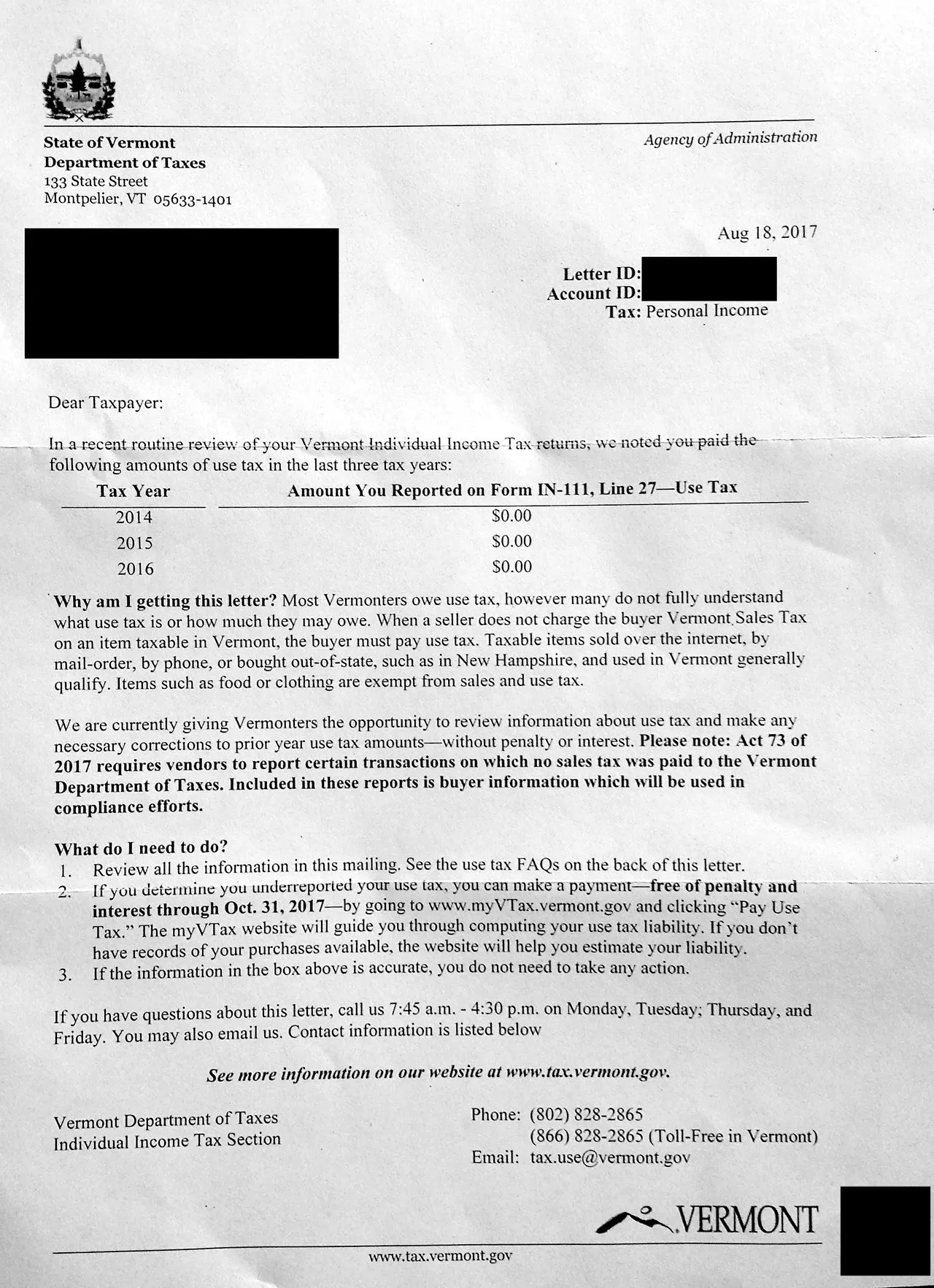

Vermont tax statutes regulations Vermont Department of Taxes rulings or court decisions supersede information presented here. HOMESTEAD DECLARATIONPROPERTY TAX CREDIT. See the notice printed on the back of your tax bill for more important information provided by the Vermont Department of Taxes.

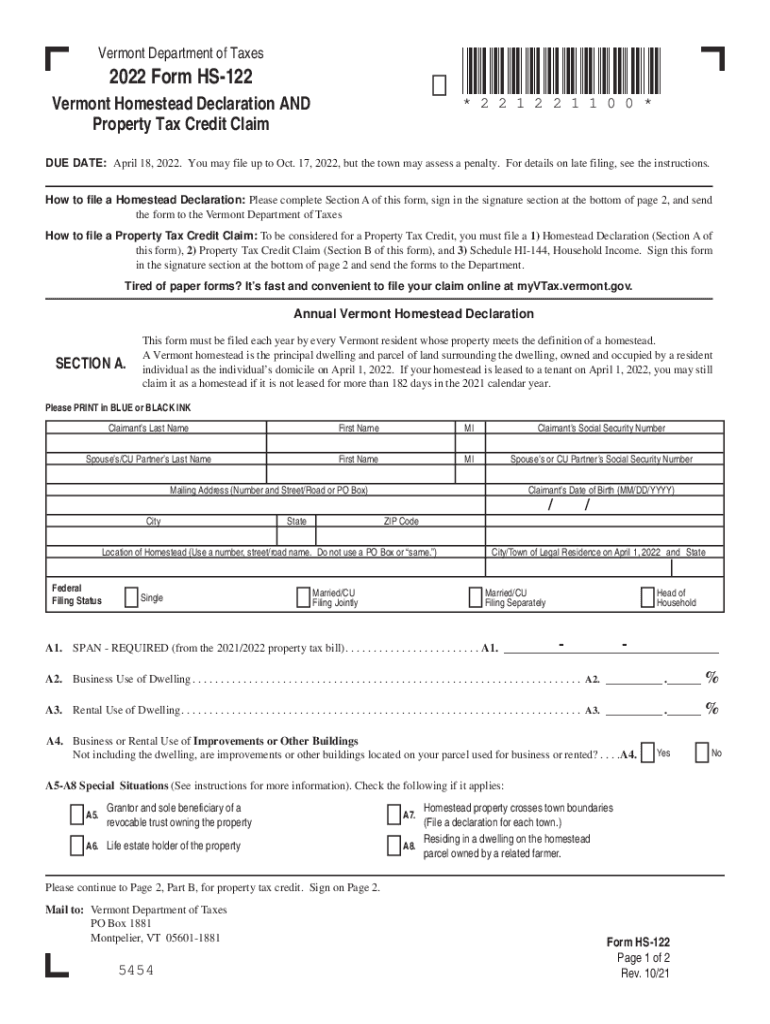

For this purpose property is categorized as either non-homestead or homestead. Printing and scanning is no longer the best way to manage documents. Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim.

Download or print the 2021 Vermont Form HS-122 HI-144 Homestead Declaration AND Property Tax Adjustment Claim for FREE from the Vermont Department of Taxes. Homestead Declaration and Property Tax Credit Filing Department of Taxes Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax. PA-1 Special Power of Attorney.

In Vermont all property is subject to education property tax to pay for the states schools. A reminder to everyone to please file your Homestead Declarations as soon as possible. The change or amendment must be done within three years from the April due date.

IN-111 Vermont Income Tax Return. This will reduce that portion of your total. Go digital and save time with signNow the best.

Only household income reported on Form HI-144 can be amended or changed. Due to the current health situation the due date has been moved from April 15 2020 to July 15 2020. To learn more visit the Vermont Department of Taxes Homestead Declaration webpage.

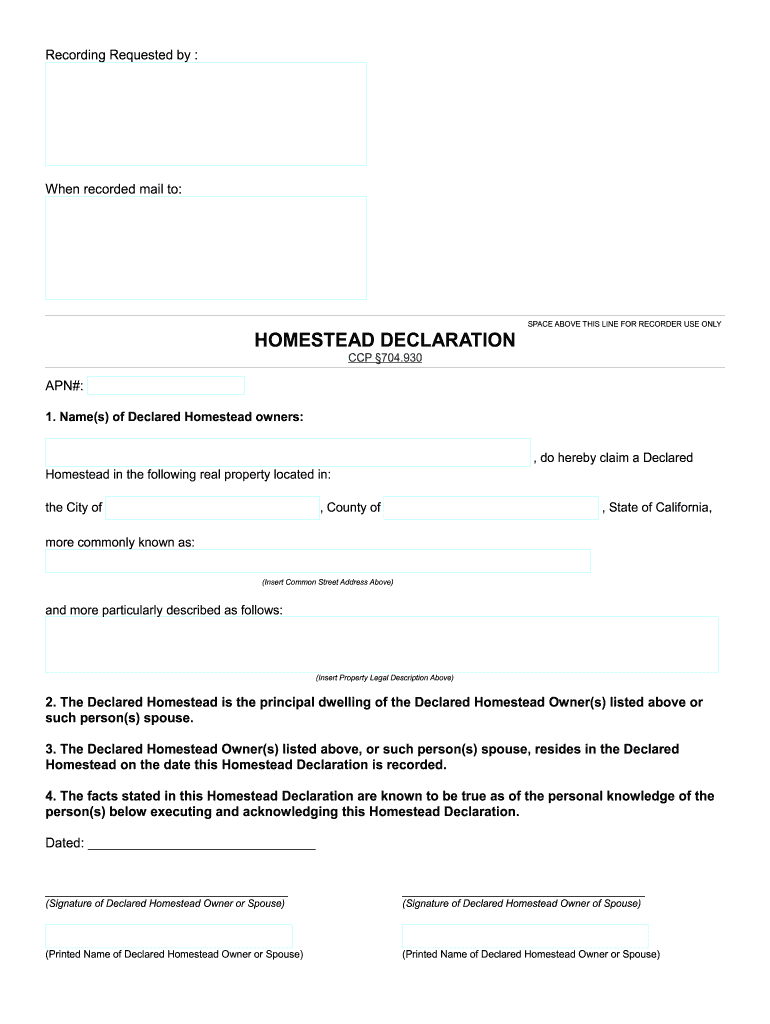

A Vermont homestead is the principal dwelling and parcel of land surrounding the dwelling owned by a resident individual as of April 1st and occupied as a persons domicile. PA-1 Special Power of Attorney. Homeowners eligible for a credit are those who 1 owned the property as a principal home on April 1.

Form Hs 122 Hi 144 Fillable Homestead Declaration Property Tax Adjustment Claim

Vermont Tax Department Sends Letters Seeking Unpaid Sales Tax Off Message

Vermont Homestead Declaration Unusual Situations Youtube

Vermont Landlord Certificates Due To Tenants Vhfa Org Vermont Housing Finance Agency

Hi 144 2017 Form Fill Out Sign Online Dochub

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Tax Forms And Instructions For 2021 Form In 111

Vermont Homestead Form Hs 122 Fill Out Sign Online Dochub

Ca Homestead Declaration Fill Online Printable Fillable Blank Pdffiller

2022 Form Hs 122 Fill Out Sign Online Dochub

Vermont Department Of Taxes Youtube

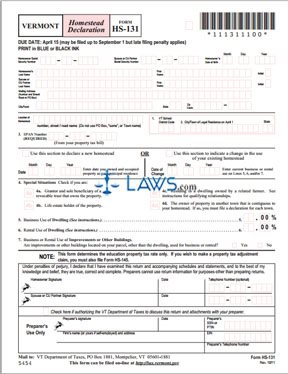

Free Form Hs 131 Homestead Declaration Free Legal Forms Laws Com

Vt Form Hs 122 Download Fillable Pdf Or Fill Online Vermont Homestead Declaration And Property Tax Adjustment Claim 2019 Vermont Templateroller

How To Register For A Sales Tax Permit In Vermont Taxvalet

Reminder U S And Vermont Income Taxes Must Be Filed By May 17

Form Hs 122 Hi 144 Fillable Homestead Declaration Property Tax Adjustment Claim

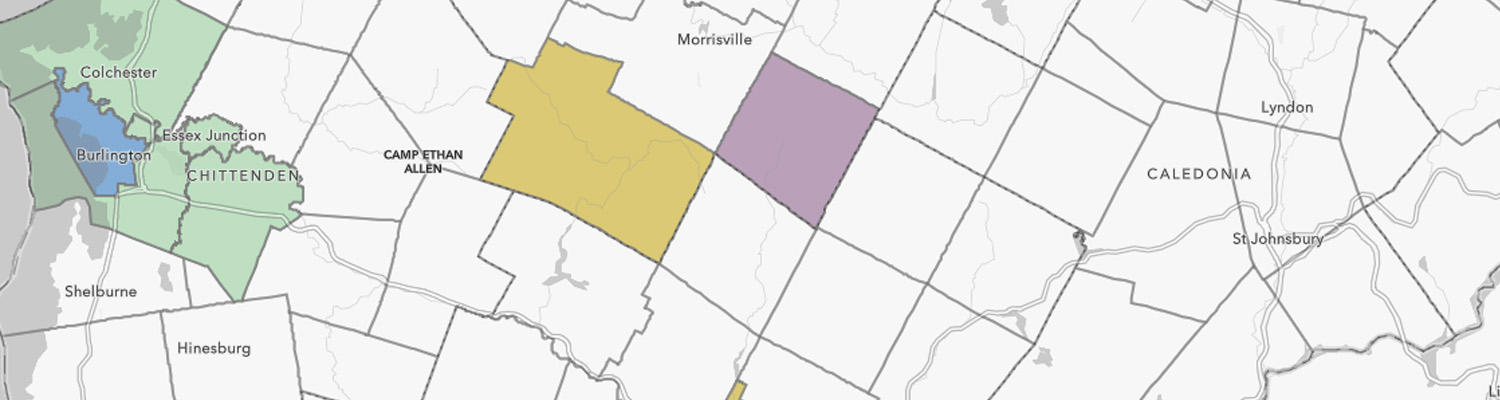

State Tax Treatment Of Homestead And Non Homestead Residential Property

Vermont And Federal Income Tax Filing Deadline Pushed Back To May 17 Vtdigger